Drive Your Business Success: Moving Beyond Growth for Financial Health

In a recent virtual session hosted by Amanda W. Higgins of Full Cup Solutions, business owners gained critical insights into evaluating performance and setting a strategy for a strong Q4 finish. Featuring financial experts Erin Nagle (Glenn Burdette CPA) and Hayley Hightower (AgWest Financial Institution), the discussion centered on a crucial shift in mindset: moving from relentless aggressive growth to focusing on strategic financial stability and understanding the non-linear business life cycle.

Navigating Stability: The Power of the Non-Growth Strategy

For many in the wine industry and beyond, the current market calls for a strategic pivot. CPA Erin Nagle emphasized that many businesses are wisely moving into a stable, non-growth mode.

This strategy is not about standing still; it's about protecting what's built and ensuring a healthy balance sheet by generating consistent, predictable cash flow.

The J-Curve and Critical Metrics

Any aggressive growth strategy—whether it's market expansion or a capital project—is likely to follow the J-Curve Analogy. This concept dictates that heavy investment causes a temporary dip into negative cash flow (the bottom of the 'J') before increased revenue catches up on the other side. Sustaining this period requires meticulous planning.

To survive the J-curve and maintain stability, businesses must diligently track key financial metrics:

Cash Flow Projections: Essential for servicing debt and maintaining operations.

Gross Profit Margin (GPM): A 50% GPM is a solid benchmark. However, profitability hinges on controlling subsequent costs.

Controlling Expenses: A business needs to ensure General & Administrative (G&A) costs are typically no more than 20% of GPM, and Selling Expenses are between 20-30%. If these ratios are out of balance, the GPM quickly evaporates.

Timely Tracking (Scorecard): Key Performance Indicators (KPIs) must be monitored regularly—like a financial scorecard—not just at year-end, to allow for timely course correction.

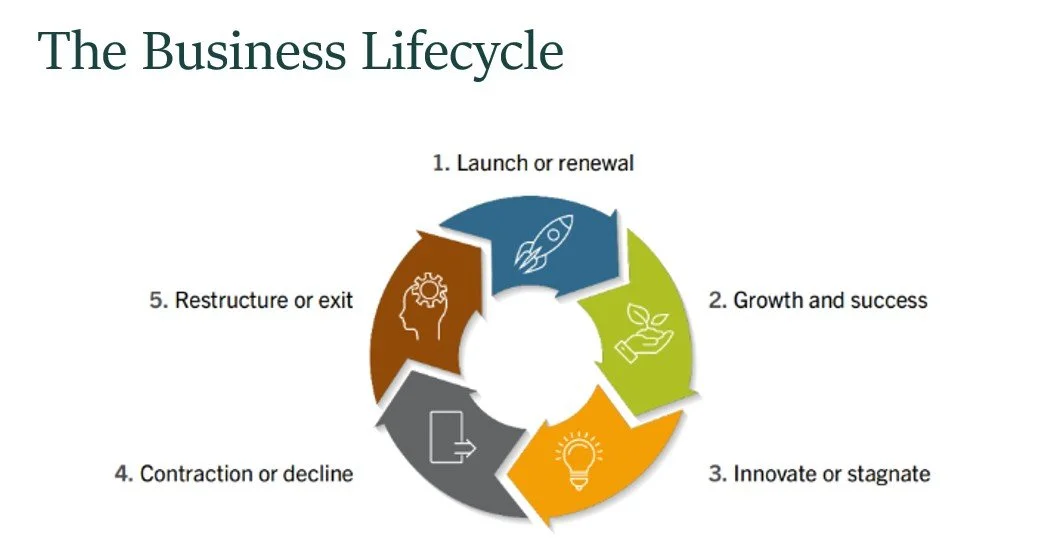

The Non-Linear Business Life Cycle

Hayley Hightower of AgWest Farm Credit broke down the standard business life cycle, stressing that it is not linear and can apply to specific projects within a mature company (e.g., replanting a vineyard). Understanding your current stage is vital for financial planning.

Image courtesy of AgWest Farm Credit

Key Strategies for Success

The experts shared pointed advice for decision-making and improving the bottom line without focusing on top-line growth.

The Cost of Opportunity: As the saying goes, "When you buy something, you end up with the thing and not the money." The temptation of a "good deal" (like buying cheap fruit) must be weighed against the loss of liquidity. Cash is flexibility and opportunity.

Failing to Decide is a Choice: Business owners must make conscious, deliberate decisions about their strategy (growth vs. non-growth). In a challenging market, choosing to do nothing is still a deliberate action with consequences.

Non-Growth Revenue Tactics: To grow the bottom line without growing the top line, the focus should be on contracting costs (e.g., labor, production overhead). By reducing expenses based on realistic sales forecasts, you can significantly improve profitability.

Final Advice

Work the Numbers: Financial statements are tools to make better decisions, not just for the IRS or banks. Convince yourself first that a move is financially sound before approaching partners or lenders.

Lean on Experts: As a business owner moves through the life cycle, they must rely on professionals—CPAs, consultants, and lenders—to help protect the investment while the owner focuses on the core business.